Problem Statement:

Branch managers and senior loan officers require access to all loan information in their region in order to manage their loan portfolio

Field officers need access to customer loan profiles while on the go

Standardized and accurate client data is essential for reducing delinquency and fraud

Project Overview:

ThitsaWorks Solutions Myanmar Co., Ltd. is a financial technology company that provides financial technology solutions for Microfinance Institutions and other financial institutions to collect, manage and analyze data needed to run effective operations and to manage risks. ThitsaWorks is passionate about solving complex business and social challenges using data as a tool.

MCIX is developed under the guidance of the Myanmar MicroFinance Association and the Financial Regulatory Department of the Ministry of Finance and Planning.

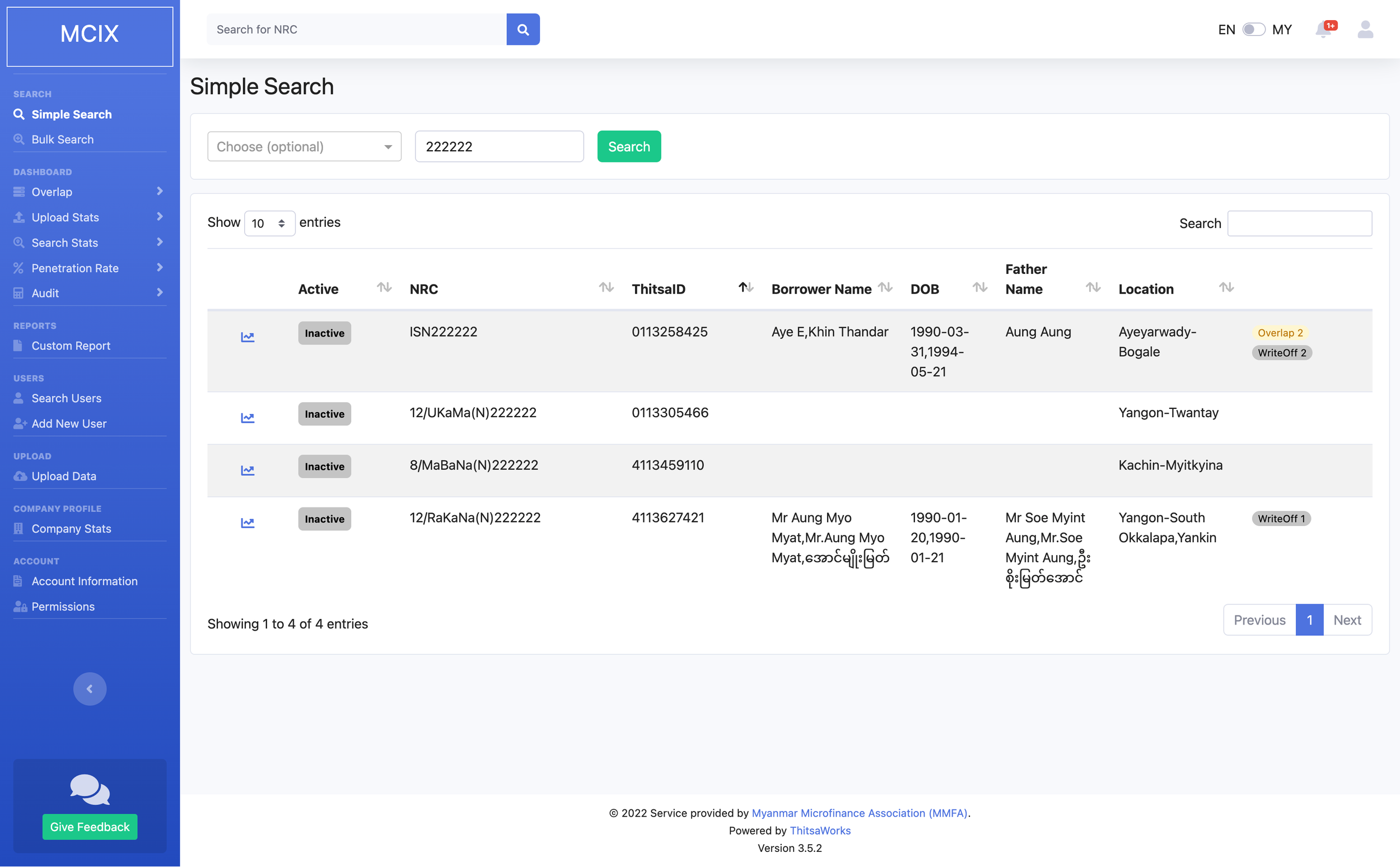

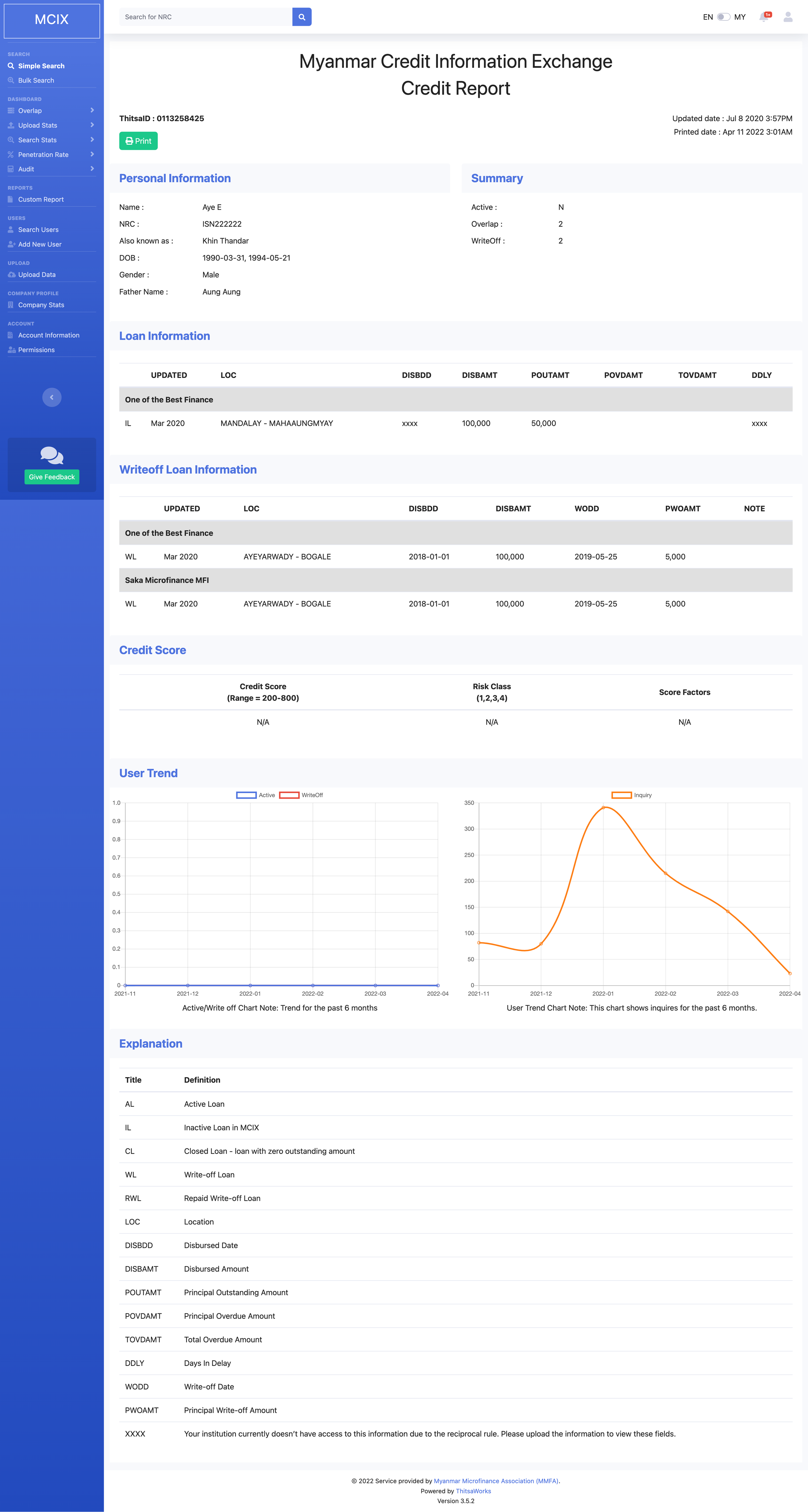

It enables all the members of micro finances to achieve better credit assessment since it provides access to the credit information that MFIs could never receive such as Overlap Reports, Delinquent and Write-Off information from other MFIs.

Role & Responsibility:

As the product designer for this project, I closely collaborate with the product owner to establish the product direction, make product decisions, conduct workshops and develop the design system.

✅ Summary of what I’ve learned

I learned how to design a complete SaaS system.

I created event journeys and interfaces within a complex system of user permissions and roles, handling extremely private data, and multi-organizational architecture.

I led the design process and execution for a desktop and mobile asset management application.

Challenges:

Loan information sharing needs to be standardized across different MFIs.

Loan information must be updated and monitored promptly to maintain an accurate database.

Sharing client data between branch managers and loan officers can be challenging.

Discover Phase

To gain insight into microfinance processes and the challenges they face, we conducted several interviews with different types of officers who work in microfinance, from the main office staff to field officers. By synthesizing this research, we were able to identify user groups and assign tasks for the app.

Definition Phase

We designed two platforms:

a web app with full functionality for main office and branch managers,

a mobile app with limited functionality for field officers.

In order to accommodate different types of users, we also created credential levels for the web app. The mobile app is designed to provide loan officers with access to relevant client data while working in the field.

Design Phase

We held several workshops with different MFIs to refine the application flow and developed a data collection standard to standardize the information format across MFIs.

Final Design:

One of the challenges we faced during the design phase was standardizing the visual language across platforms. The features available on both the web app and mobile app needed to be intuitive and the data format needed to be optimized for both desktop and mobile screens.

Desktop Design

Mobile Design

The Result:

The MCIX portal and mobile app were delivered in March 2021 and are currently used by 60 MFIs in Myanmar. We have received positive feedback from our MFI partners because the app helps them reduce their delinquency rate and the reminder feature allows them to offer new loans to recurring borrowers in a timely manner.

“In addition to his UI/UX and project management skills, Mike is excellent in oral and written communications. Mike not only developed the visual elements, but he has also drafted brand guidelines, reports, and project documentation and conducted presentations for various organizations' senior representatives.

Mike is a reliable and productive team member who can deliver good results efficiently and works well under tight deadlines. Mike has outstandingly cooperated with team members and partners in all the projects.”

Nyi Nyein Aye -CEO & Managing Director